Zero-Off USDA Home loans vs FHA compared to Conventional 97

How Sensible Are USDA Home loans?

The usa Agencies out of Agriculture (USDA) financing, labeled as the fresh (RD) mortgage, means no advance payment that will be open to straight down-borrowing people.

Interest in these types of loans keeps growing because customers understand the gurus. More than 166,000 parents used an excellent USDA loan inside fiscal year 2015 alone, depending on the company.

Customer enthusiasm isnt surprising. This new USDA loan ‘s the only on the market today having homebuyers in the place of armed forces solution background.

Rural Invention finance arrive according to located area of the assets, maybe not existence sense. Specifically, USDA consumers you desire merely to come across property in the good rural urban area since outlined by USDA. Nevertheless concept of rural is pretty liberal: regarding the 97 per cent of all the You.S. residential property bulk is eligible.

USDA Pricing And Financial Insurance

USDA finance succeed 100% capital, meaning zero downpayment becomes necessary. The reason being USDA loans was insured, otherwise recognized, of the U.S. regulators.

No down payment does not always mean people pay highest costs. USDA finance give equivalent otherwise all the way down pricing than simply is obtainable that have FHA or conventional loans.

USDA loans, but not, have hook downside than the Traditional 97 because it have an upfront commission of just one.00% of your own amount borrowed. The cost isn’t needed in the bucks within closure. Alternatively, the total amount was covered on prominent equilibrium and you will repaid throughout the years.

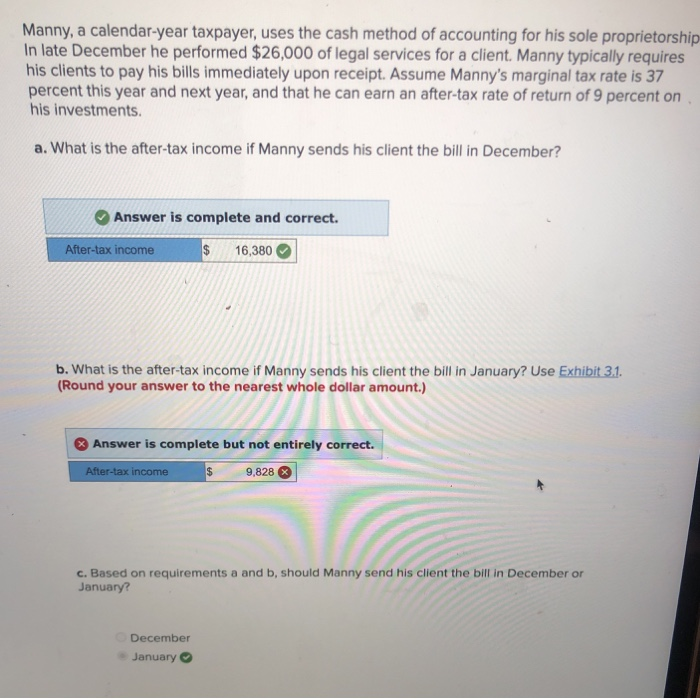

USDA Can cost you Compared to FHA and Traditional 97

The point that USDA loans don’t require a down-payment preserves new family client a substantial count initial. It reduces the amount of time it needs a buyer so you can end up being happy to get a house.

Almost every other lowest-down-payment options, like FHA loans or a normal 97, however require a down-payment off step 3.5% and you can step 3% respectively.

For the mediocre household price of on the $250,000, an effective USDA debtor will need $8,750 quicker initial than simply a keen FHA borrower.

USDA loans come with a higher harmony, on account of reasonable advance payment, but that’s some offset by lower cost and much more sensible financial insurance policies.

Down payment

- USDA: $0

- FHA: $8,750

- Conventional 97: $seven,500

Amount borrowed

- USDA: $252,five-hundred

- FHA: $245,471

- Conventional 97: $242,five-hundred

Monthly Principal, Appeal, And you can Home loan Insurance rates

- USDA: $step one,280

- FHA: $step 1,310

- Antique 97: $step one,385

Understand that these types of money dont were almost every other will cost you including assets taxes and you may homeowner’s insurance policies, as they are according to try, rather than alive, cost and ple implies that USDA requires a similar payment compared to the FHA, without having any step 3.5% downpayment.

Whilst USDA loan amount is actually high on account of no downpayment, monthly installments are the same or lower than one other possibilities.

Payment is much more extremely important than simply dominant balance for some customers. All the way down month-to-month can cost you make the USDA loan less expensive to possess family members that have tight finances.

Minimal Credit history To own A great USDA Mortgage

USDA mortgage brokers have most other masters along with reduced very first and you will monthly costs. They likewise have versatile credit standards compared to most other financing versions.

To possess good USDA financing, home buyers will only need a credit rating of 640. Fannie mae advice place the minimum credit history within 620 to possess a conventional 97, even in the event loan providers usually usually lay a high at least 640 so you can 680.

The actual only real well-known financing program with a reduced expected credit history try FHA, and therefore just demands a credit score out-of 580.

USDA Income Limitations Make certain Supply To own Moderate Earners

USDA home loans are around for customers on or lower than specific money constraints. So it assistance is determined set up to make certain the application can be used because of the individuals who are interested extremely.

But the earnings constraints having a USDA was big. Are USDA eligible, the house buyer makes around 115% of area’s median income. And if children off four, below are new yearly income restrictions for the majority biggest components:

Huge families are allowed and also make much more. Such as, children of five or even more on La town can make $129,600 whilst still being be eligible.

Exactly what are Today’s Costs?

Given that USDA funds is actually backed by the usa quick cash loans in Monte Vista Service out-of Farming, they offer advantages one others never, particularly small upfront will cost you and ultra-reduced prices.

The latest sagging criteria, simple affordability and you will 100% financing provided with a beneficial USDA home loan make it an emotional solution to beat.

Score an excellent USDA rates price, which comes having an possessions and you may earnings qualifications view. Most of the estimates is usage of your own real time fico scores and you can a great custom monthly payment estimate.

*The fresh new payments found significantly more than guess a beneficial 720 credit rating, single home, and you will possessions within the Arizona County. Old-fashioned 97 PMI rates are supplied by MGIC Ratefinder. Money do not become possessions fees, homeowner’s insurance rates, HOA expenses or any other will cost you, and are also according to example APRs that will be meant to have shown an assessment, perhaps not currently-available pricing. Attempt APRs made use of are listed below: USDA 4% APR; FHA 3.75% APR; Conv. 97 cuatro.25% Apr. Seek advice from a loan provider right here to own a personalized price and you will Apr estimate.