Operating on that ebb and you may circulate are tens of thousands regarding financial operate tied to financial originations and you may refinancing

At the same time, Truliant Federal Borrowing Union turned into inside December the first Vermont-built financial institution to do an eClosing, according to the Letter.C. Assistant of Nation’s workplace.

A keen eClosing are good completely electronic and you may completely remote electronic home loan closure. It absolutely was the first eClosing from the county the spot where the customer – an excellent homebuyer within the Queen – notary and you will lawyer have been in almost any actual urban centers.

Beth Eller, Truliant’s vice president of Home loan Properties, asserted that since the a digitally motivated borrowing from the bank connection, the new secluded on the internet notarization choice is a good should have providing for all of us on mortgage town.

Refinancing waning

National domestic real-home lookup company Attom told you next-one-fourth mortgage originations across the nation was indeed off thirteen% about first one-fourth and you can 43% out-of last year.

This new refuse lead of a special double-hand downturn inside the refinance hobby that over outweighed increases in the home-purchase and you will family-collateral lending, Attom said.

Home loan costs which have nearly twofold for the past 12 months has decimated the new re-finance sector and they are starting to simply take a cost on the purchase credit too, said Rick Sharga, exec vice-president of field cleverness from the Attom.

The mixture from much higher home loan pricing and ascending home prices makes the thought of homebuying just unaffordable for most potential customers, and this threatens to drive mortgage regularity down even more even as we exit the brand new spring season and you may summer time.

Attom quoted that the 941,000 residential loans that have been rolled over towards the the new mortgage loans while in the the second one-fourth is actually down thirty-six% regarding first quarter and you may down 60% 12 months more than year.

As a result, for the first time given that payday loans North Johns very early 2019, re-finance hobby regarding second one-fourth failed to portray the greatest chunk away from mortgage loans, shedding to 39% of all of the funds, Attom stated. That has been removed from 53% in the 1st one-fourth and you can regarding a recent level out of 66% in early 2021.

No wonder

This new retrenching from financial financing by the federal and you can super-local banks is not a startling pattern, said Bankrate specialist Greg McBride.

This is the resumption regarding a trend that has been not as much as method due to the fact economic crisis away from 2008, McBride said. In which big financial institutions pull back, most other faster lenders rapidly complete the fresh emptiness.

McBride cautioned that larger banking companies pull straight back to the home loan credit continue to be most active inside home loan repair so that they keep up with the consumer touch section without any regulatory likelihood of originating the borrowed funds.

Fast submit 2 years assuming environmental surroundings are way more that lead to a trending home loan industry, the top banks could be back.

Tony Plath, a resigned money teacher during the UNC-Charlotte, said finance companies are increasingly being challenged by an excessive amount of financing also have and you will insufficient mortgage request.

New also have cutback is a response to the supply-side imbalance in today’s home loan sector, additionally the abrupt collapse of one’s level economies that drive home loan mortgage success.

Plath, yet not, was optimistic your cyclic characteristics out of residential home loan credit tend to move right back enough to draw in federal and extremely-regional banking companies to stay mixed up in markets.

When we done so it newest off stage of one’s financial credit course, and you will loan costs try once more down which have housing also provide far more abundant and you may absolutely cost, every financial institutions already pull straight back in the world have a tendency to plunge straight back for the with both base, Plath said.

Plath told you when that takes place, banks, fintechs and other lenders you to continue to develop and get better the digital mortgage products commonly enjoy advantages.

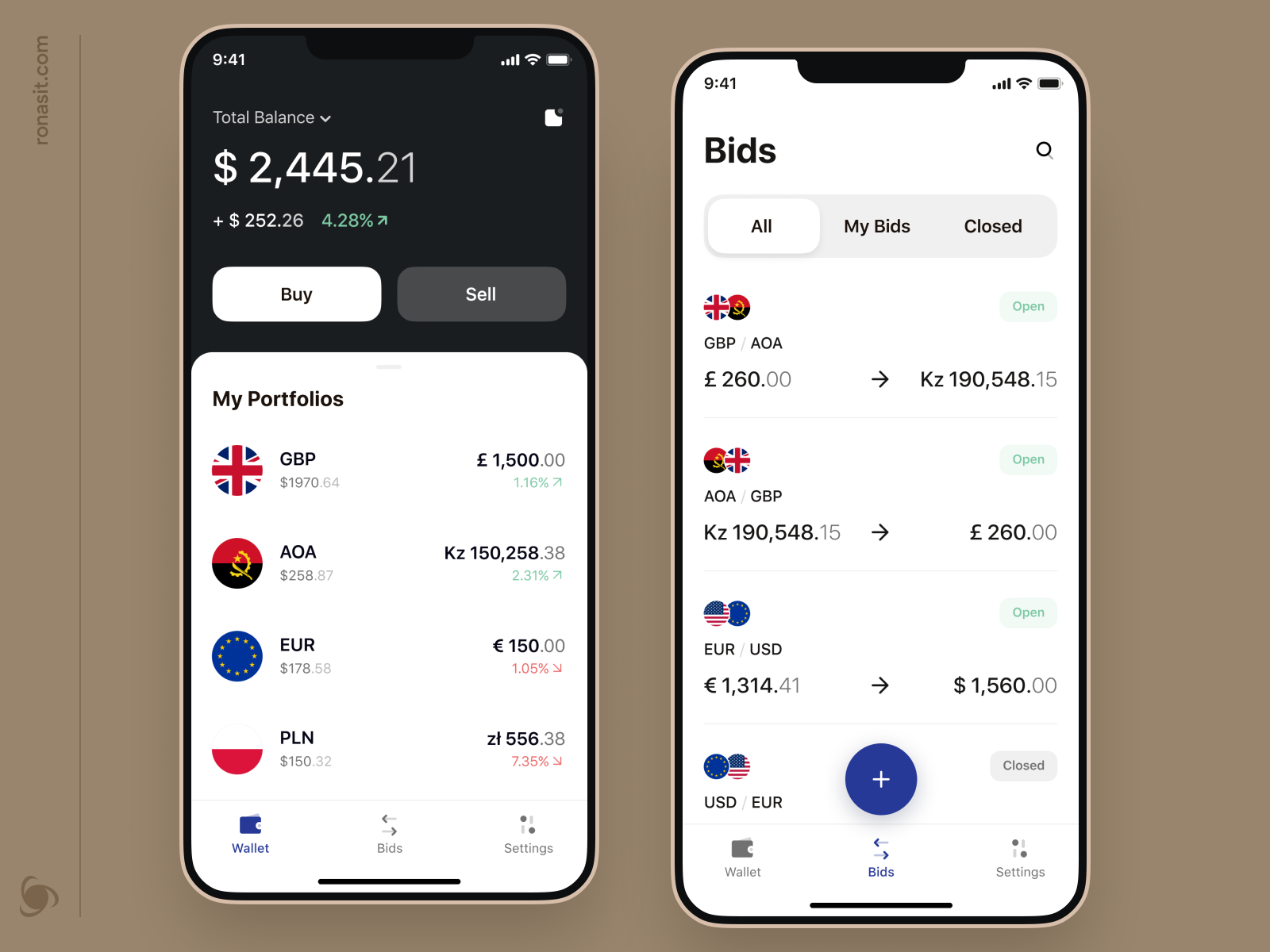

The truly fun transform that is happening today is the advancement toward electronic, online mortgage origination and you will mortgage closing that’s displacing brand new real mortgage mortgage shipment route, Plath said.

The latest disperse for the digital origination and you will closings commonly totally replace the measure economies of your own world in the years ahead, and that is probably has actually a giant effect on ways consumers purchase, and financing, house in the future.

On Aug. twenty two, Truist announced they got offered its come to in artificial cleverness by the obtaining some assets from Zaloni, plus the Arena system. Truist told you the purchase will speed the investigation governance, metadata administration, complex analytics, and you will artificial intelligence and you may server understanding (AI/ML) programs.