Who’s entitled to an unsecured loan which have LendingTree?

Deb Hipp try a self-employed author with well over a decade out of financial writing experience in the mortgage loans, personal loans, handmade cards, insurance rates, and debt.

- One of the largest on line mortgage marketplaces from the U.S. with well over 300 loan providers

- Zero charge to have complimentary borrowers having lenders and other charge

- Loan providers constantly respond to loan requests within minutes

-

New Mexico title loans NM

- Cosigner release isn’t readily available if you do not has reached least midway as a result of your own payment name

Depending during the 1996 in the Charlotte, is actually an on-line loan marketplace with a system out of hundreds of lenders giving unsecured loans, mortgages, domestic security money, auto loans, and more. If you are searching to possess a consumer loan to pay off financial obligation or make a large purchase, LendingTree makes it possible to find a very good choice.

LendingTree also offers a streamlined financing request processes, complimentary individuals with lenders about organization’s grand network. That have numerous interest levels and you can loan terms and conditions of over three hundred loan providers, LendingTree will be great for looking for your own mortgage.

- How come LendingTree works?

- Positives and negatives

- Simple tips to pertain

- FAQ

How come LendingTree works?

Just fill in an easy on line otherwise phone financing demand in order to LendingTree, and therefore checks their credit which have a mellow remove that does not apply at your credit rating. When lenders function (normally within a few minutes), LendingTree displays each lender’s render browsing efficiency.

Per lender comes with the provide pricing and terms and conditions for easy evaluation with other lenders’ even offers. After you undertake a deal, you works myself to your bank accomplish your application. This might tend to be a challenging borrowing inquiry, guaranteeing what your accessible to LendingTree, and you may finishing applications.

LendingTree costs, borrowing limitations, and you can fees

Cost off LendingTree’s financial circle begin at 5.99% . But not, depending on the credit, earnings, most recent loans, and other issues, the loan Annual percentage rate shall be up to % .

Loan installment periods are different by the bank. LendingTree costs zero costs because of its loan review properties. not, lenders may charge their own charge, which are very different by lender.

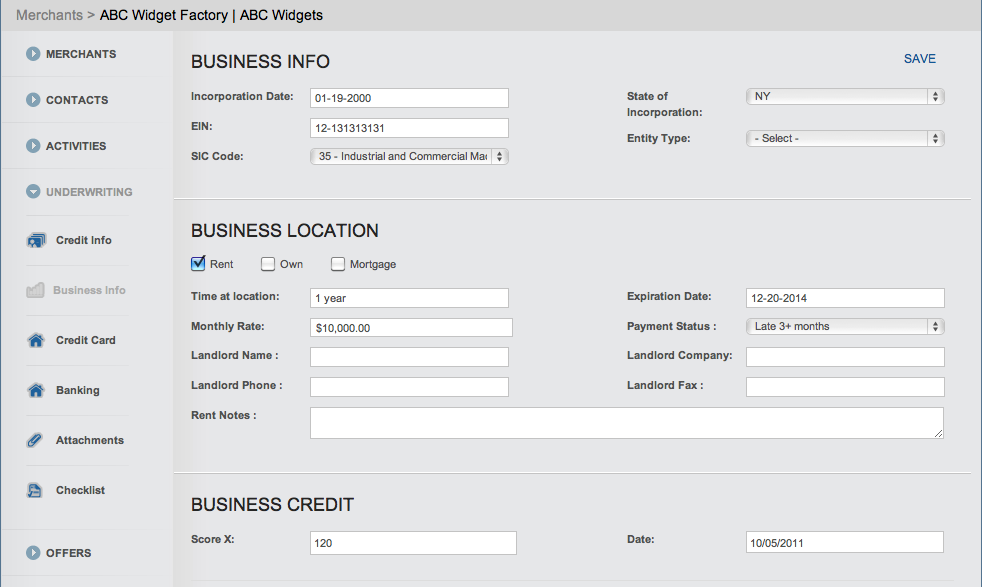

Residents of the continental Us, Alaska, and you may Their state are eligible add a consumer loan demand to LendingTree. Loan providers on the LendingTree circle provide unsecured otherwise secured personal loans having APRs between 5.99% to % or more.

The financial institution considers your credit score, plus earnings, financial obligation, and other circumstances. Essentially, the greater your credit rating, a lot more likely you’ll be able to located a lesser Annual percentage rate.

LendingTree as well as partners having lenders which give funds to the people which have less-than-finest borrowing from the bank. However, remember that if your credit score is gloomier than just 660 this new Apr essentially jumps up to % or more.

LendingTree’s loan procedure is clear. It screens per lender’s Apr or other loan details which means you can easily examine loan also provides. Qualifications having a personal bank loan may differ due to the fact per bank has its own own qualification criteria.

How will you pay-off a great LendingTree financing?

The lending company you select will establish this new fees several months for the personal bank loan. The lending company might render payment guidance such as the best places to spend on line otherwise because of the send. Financing conditions will vary from the lender and you can believe your credit, income, number of loans, and other factors.

Per financial will give info on the fresh Apr, cost months, or other conditions in mortgage give, plus perhaps the loan shall be paid down very early and you will one prepayment penalties.

Regarding financial also offers, it is important to know how the loan words will affect month-to-month costs and full count you need to repay.

Particularly, this is what you might spend into low interest you can toward LendingTree to have a great $10,000 financing that have a five-season title.