Ohio First-Day Homebuyer Software (finest applications for you)

Installing household when you look at the Ohio has some advantages (excluding Tornadoes which will make you stuck having yellow slippers). Like the condition having the 5th-shortest average performs drive in the united states, 21% less expensive from life versus national average, and lower than-mediocre property costs.

This one is so recognized for making money continue you to definitely U.S. Reports & World Statement rated Ohio #7 on their set of the least expensive locations to call home in the us.

However, regardless of what sensible the state are, i will generate earliest-time home buyers as if you save far more currency from the sharing little-known grants and you will programs that’ll help in keeping more income on the pouch. Therefore in the place of further adieu, let us start.

Ohio Very first-go out Homebuyer Grant (the brand new realities)

Allow me to totally free you from this new anxiety off thought you’ll be able to must save up 20% for a down-payment.

Just like the Kansas Housing Department provides set up a fairly sweet package to own first-day customers on state. But before I have to that particular, very first we should instead score clear on how do be eligible for this offer.

For one, just be a first-time homebuyer (which means that you have not owned a home in the past one or two years). And also to be eligible for the brand new give, attempt to set at least 2% off with the buying your brand new home, that fund information tend to be:

- The application form allows good 0% financing as much as 20% of the residence’s price.

- The mortgage are fully forgiven for people who remain in our home for 10 years.

- Earnings limitations incorporate. For example, the maximum qualified earnings to possess https://paydayloanalabama.com/phil-campbell/ children of five inside the Allen Condition try $44,two hundred, inside the Sedgwick County try $58,3 hundred, plus Leavenworth State was $66,150.

- There’s absolutely no specialized credit score criteria, nevertheless must be able to secure a first home loan which have mortgage in accordance with current market costs.

- The application isnt found in Kansas City, Lawrence, Topeka or Wichita town restrictions, otherwise around Johnson Condition.

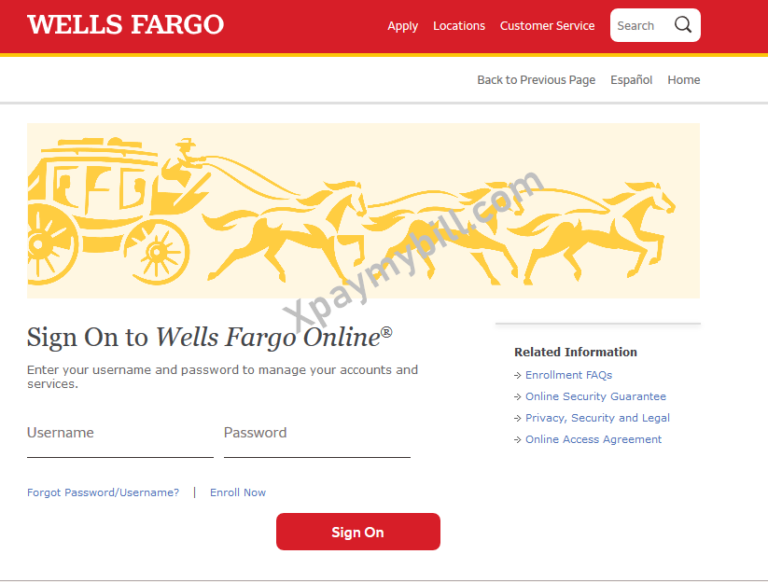

You might apply for the applying from the reaching out to an enthusiastic accepted lender. The lending company can assist you which have qualifying to your financing, event the necessary paperwork, and getting your good preapproval letter to help you begin hunting for your house.

(btw, a knowledgeable funding so you can identify gives and applications was your own agent. Thankfully, we understand an educated of them close by. Only complete this new short means below discover connected to possess free).

This new Ohio Construction Recommendations System

The Ohio Homes Assistance Program also provides a thirty-seasons fixed-rate mortgage and gives doing 5% of one’s price to cover the downpayment otherwise closing will set you back. Low-money buyers might possibly availability a supplementary $dos,five hundred so you’re able to offset a lot more costs. You really need to have a credit rating of at least 640 for the application and you will secure no more than 115% of one’s area’s yearly average earnings. Cost criteria don’t let with the acquisition of property you to exceeds $484,350 in expense.

You could start the applying processes from the calling an excellent performing bank, who will make it easier to accessibility mortgage applications and you can offer financing.

Think about closing costs?

Because you begin to buy a home loan, possible listen to lenders explore closing costs. Exactly what was settlement costs, and what is the complete expense? Closing costs tend to be numerous charge, like the household appraisal, credit assessment, name browse, and much more. Generally, these will set you back add up to up to 2 in order to 5% of residence’s price. Such as, if you purchase good $two hundred,000 domestic, closing costs you will range between around $cuatro,000 to $10,000.