Such standards let lenders assess your ability to settle the mortgage responsibly

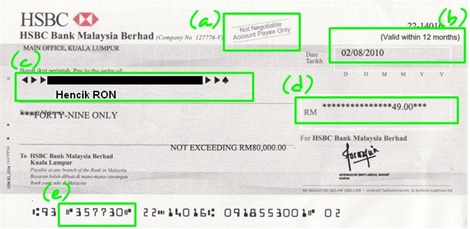

show this:

Unlocking the potential of your own residence’s guarantee courtesy a home Security Credit line (HELOC) also have residents which have monetary freedom. A great HELOC is different from a traditional home collateral loan by offering a great rotating personal line of credit, allowing you to borrow funds as required to your own recognized limit. Knowing the HELOC app techniques, including qualifications standards plus the mark and you will fees periods, is important for making told economic behavior.

Qualifying having a beneficial HELOC: Key Requirements

To increase recognition to have an effective HELOC, lenders typically consider several facts, together with how much cash equity you have of your property, your credit score, and your loans-to-earnings proportion.

Adequate Family Equity

To help you qualify for a beneficial HELOC, people should have adequate security in their possessions. Security is the difference between the house’s economy worthy of and you will your the financial balance. For example, whether your home is valued from the $300,000 along with a home loan harmony away from $150,000, your property security was $150,000. Lenders normally wanted borrowers to own at least 1520% security just before giving a good HELOC application. It indicates their mortgage balance is going to be 8085% or a reduced amount of the residence’s value.

Reputable Earnings

Lenders want proof of consistent earnings to make certain you could perform the extra monthly installments with the a beneficial HELOC. So you can qualify, you may need to provide files like:

- A career earnings. W-dos setting, lender comments, and you will latest shell out stubs

- Self-a position money. Tax statements and you can money losings statements

- Retirement income. Social Safeguards comments, your retirement, or annuity recommendations

- Most other income supplies. Records for all the more money, for example local rental property earnings otherwise investment returns

Solid Creditworthiness

A powerful credit history and you may responsible borrowing management are essential having HELOC recognition. Loan providers very Pike Road loans carefully evaluate your own creditworthiness to determine the loan qualification. A credit history generally a lot more than 680, coupled with an everyday reputation of for the-date costs, shows debt reliability. Strengthening and you may maintaining a robust borrowing from the bank reputation makes it possible to secure favorable HELOC terms.

Lower Personal debt-to-Earnings Ratio

The debt-to-money (DTI) proportion tips the month-to-month debt costs (handmade cards, automotive loans, an such like.) relative to your revenue. Lenders use DTI to evaluate your capability to deal with even more monetary debt. A lower DTI, generally speaking lower than 43%, generally improves your odds of HELOC acceptance. To improve their DTI, envision paying off established obligations, broadening income, otherwise refinancing higher-desire loans.

Skills HELOC Draw and Repayment Periods

A great HELOC operates in 2 phases: this new mark months while the fees months. In the draw months, normally lasting from around 5 so you’re able to 10 years, you have access to loans as needed, to the credit limit. You happen to be generally obligated to generate notice-just payments during this time, many loan providers also can require money with the the principal. Due to the fact draw several months ends up, this new fees months starts, and you might build each other prominent and you may attention payments. The length of so it stage may differ by the financial, but may focus on any where from 5 to help you 20 years.

How-to Apply for a beneficial HELOC

Protecting property Guarantee Line of credit relates to multiple procedures. By the facts such strategies, you can browse this new HELOC software processes and then make informed behavior.

1 | Gather required papers

To start brand new HELOC application, gather essential documents particularly proof income (spend stubs, taxation statements), homeownership confirmation (property tax bill, financial report), and you may identity. With these types of data readily available tend to streamline the application form processes.

dos | Complete the app

Very creditors give online applications getting benefits, while some banks and you can credit unions choose your apply inside the-person on an area branch. Anticipate to promote detailed information concerning your finances, assets, and need HELOC terms and conditions.

step 3 | Waiting from the underwriting procedure

Lenders commonly comment the application, evaluate their creditworthiness, and you can make certain your income and you will worth of. This process range between a home appraisal to determine their home’s economy really worth.

cuatro | Personal to the HELOC

Upon recognition, you are getting a loan arrangement explaining the small print. You will have to sign the loan arrangement and you can shell out people closing will cost you, in the event the relevant. A short prepared period, always a short time, allows you to opinion the newest terms and conditions until the financing will get energetic.

5 | Access The HELOC

After the closure techniques, possible access your own HELOC fund. This constantly pertains to getting good checkbook for distributions, although some loan providers allow you to import the amount of money into your individual savings account.

Happy to open the potential of their residence’s equity? Tradition Family unit members Credit Commitment offers competitive HELOC alternatives tailored towards the requires. All of our knowledgeable mortgage brokers are right here to guide you from process and help you create advised choices. Contact us today to get the full story and start your own HELOC journey.