Your loan method of, mortgage techniques, and you may interest rate all depends partly about what sort of financial support you will use

The Real estate professional and you will financing officer often walk you through the procedure and you may timeline to own capital according to types of domestic you might be to find as well as the mortgage you plan to use.

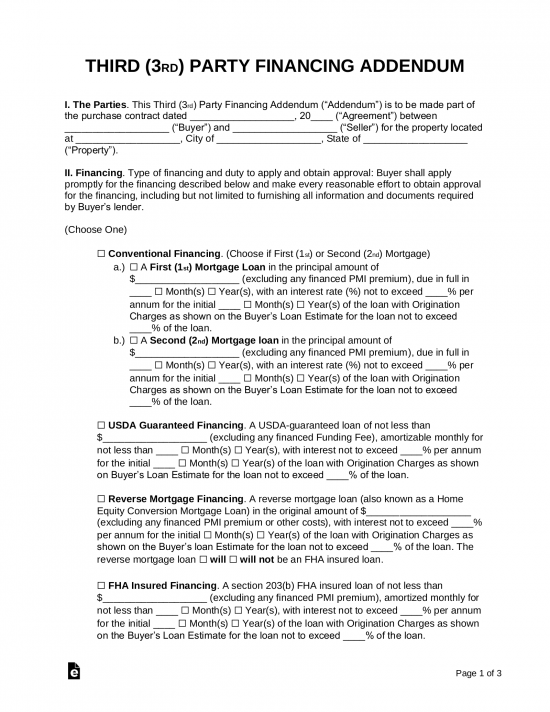

Loan models

Mortgage options with a spec otherwise tract domestic – one that is perhaps not made to their real requirements – are the same since purchasing an existing property. Possibilities were old-fashioned, Virtual assistant, FHA, and you will USDA loans. On top of that, banks and you will borrowing from the bank unions you’ll bring unique first-time homebuyer financing or lower-down-commission financing for brand new structure.

With spec and tract residential property, the brand new creator initiate build once you may be acknowledged to possess home financing and you have finalized new creator package. As financial owns new homes, you get just one mortgage that covers our house and you may land together.

Individualized land, not, need a property loan. A homes-to-permanent mortgage is a common choice provided by payday loans Ohio the new FHA, traditional, USDA, and Va software. A brief-term financing pays for for each and every stage of one’s building procedure and you can turns so you can a permanent home loan immediately following structure.

Another option is a property-only mortgage. Using this, you might play with fund to build property after which pay off otherwise re-finance the loan on a long-term financial immediately after completion regarding your panels.

If you have a contractor’s licenses and sense building a house, you might be capable of getting a manager-creator financing. In such a case. you might act as the standard company and you may located fund in order to complete the venture.

Application procedure

You must make an application for a home loan prior to beginning a unique structure investment. A great pre-recognition brings proof that you will be qualified for a specific amount borrowed.

New design homes usually include specific initial will cost you. For a specification home already constructed, the latest initial prices are similar to to shop for a current family. You can include an earnest currency put together with your provide and you’re responsible for the brand new appraisal, domestic evaluation, bank charges, and other closing costs.

If you find yourself buying a different framework tract household, you may be as well as responsible for the fresh new serious currency put, assessment, and you will family assessment. Additionally, new builder may require 1% of your price of enhancements initial. They’ll implement money toward down-payment and you can settlement costs.

The process is other to possess a custom home. With this specific brand of build, designers found finance in the more stages of your own enterprise. The bank releases currency to your specialist toward a blow agenda given that construction is completed.

Home loan conditions

Mortgage standards having area and you may specification house are an equivalent given that a current house. Your credit rating and you may deposit standards count on the sort off financial program.

Such as for instance, you will want a 620 credit rating that have a normal loan (minimum 5% down), and you may a good 580 credit rating which have a keen FHA loan (minimal step 3.5% down).

Sadly, whether or not, while you are building a bespoke home some lenders require a top lowest credit history, ranging from 680 to 720 (aside from mortgage program). Specific construction financing require also a deposit of at least 20 percent.

Interest rates for new framework

Home loan rates for an alternative design spec otherwise system family try the identical to current domestic rates. Circumstances you to dictate cost is your credit rating, the borrowed funds label, therefore the measurements of their down-payment.

At exactly the same time, structure mortgage pricing are generally greater than simple home loan costs. These fund is actually riskier since they are not covered from the a completed property. not, conversion process in order to a long-term home loan immediately following structure have a tendency to results in an effective straight down rate.

Speak to your lender throughout the price securing when purchasing a separate framework household. Which covers you from rates develops because of industry activity.